rhode island income tax withholding

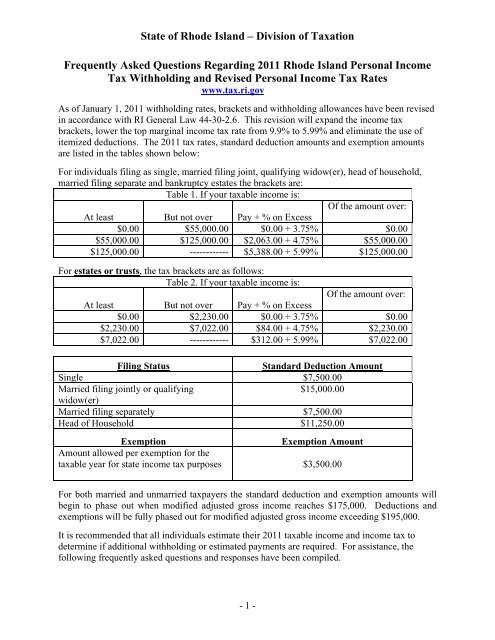

If you are not ready to transition to the Tax Portal we also support various legacy. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021.

Rhode Island Analyzes Two Year Study Considers Combined Reporting

A the employees wages are subject to Federal income tax withholding and b any part of the wages were for services performed in Rhode Island 280-RICR-20-55-106C1.

. Your actual tax liability you must file an income. No action on the part of the employee or the personnel office is necessary. Rhode Island Income Tax Withholding Certificate RI-W4 RI W-4 2022pdf.

648913 plus 599 of excess over 150550. If you are entitled to a re-. Forms Toggle child menu.

We allow for estimated payments extension payments payments with a tax filing license renewal payments bill payments and payments for various fees. Guide to tax break on pension401kannuity income. You set up your account by registering your business with the DOT online or on paper.

Corporate Taxes in Rhode Island include. What you need to know. Fund because the amount paid or credited as.

Employers must report and remit to the Division of Taxation the Rhode Island income taxes they have withheld on the following basis. With online registration it can take up to 4 weeks. Estimated tax for the taxable period exceeds.

To receive free tax news updates send an e-mail with SUBSCRIBE in subject line. Divide the annual Rhode Island tax withholdings calculated in step 6 by the number of pay dates in the tax year to obtain the biweekly Rhode Island tax withholding. The income tax wage table has changed.

Thank you for using the Rhode Island online registration service. If your state tax witholdings are greater then the amount of income tax you owe the state of Rhode Island you will receive an income tax refund check from the government to make up the difference. WEEKLY - If the employer withholds 600 or more for a calendar month.

Withholding Tax Filing Due Date Calendar 2021 2021 Withholding Tax Filing Due Date Calendar PDF file less than 1. 0 68200 000. Hold Rhode Island income tax from the wages of an employee if.

The income tax withholding for the State of Rhode Island includes the following changes. If you need help getting started feel free to call us at 4015748484 or email at taxportaltaxrigov. The Rhode Island withholding law requires employers in the state to withhold Rhode Island income tax from wages of residents for performing services both inside and outside the state and of nonresidents for service performed within the state.

Along with your Federal return at the same time as your Rhode Island tax return. RI Division of Taxation Registration Section 401-574-8829 - withholding and sales tax registration only questions. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax.

The annualized wage threshold where the annual exemption amount is eliminated has increased from 227050 to 231500. Every business corporation joint stock company or association exercising corporation functions or otherwise doing business in this state is required to file an annual tax return using Form RI-1120C and is subject to the income tax minimum 40000 under RI. The annualized wage threshold where the annual exemption amount is eliminated has changed from 234750 to 241850.

The income tax is progressive tax with rates ranging from 375 up to 599. It should take one to three weeks for your refund check to be processed after your income tax return is recieved. The Amount of Rhode Island Tax Withholding Should Be.

Rhode Island Division of Taxation One Capitol Hill Providence RI 02908. Rhode Island regulatory law provides that a Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if. Up to 25 cash back Apart from your EIN you also need to establish a Rhode Island withholding tax account with the Rhode Island Department of Taxation DOT.

7 of net. 155050 and over. 68200 155050.

To register online use the DOTs Combined Online Registration Service. 3 Even though the employees wages are NOT subject to federal income tax withholding the employer may withhold if the employee so requests. One Capitol Hill Providence RI 02908.

Rhode Island Division of Taxation. How to File and Pay Corporate Taxes. Income other than salaries or wages sub-.

No action on the part of the employee or the personnel office is necessary. The income tax withholding for the State of Rhode Island includes the following changes. Rhode Island employer means an employer maintaining an office or transacting business within this state.

The income tax wage table has been updated. 248250 plus 475 of excess over 66200. For more information please refer to the instructions provided by your Software Vendor used to.

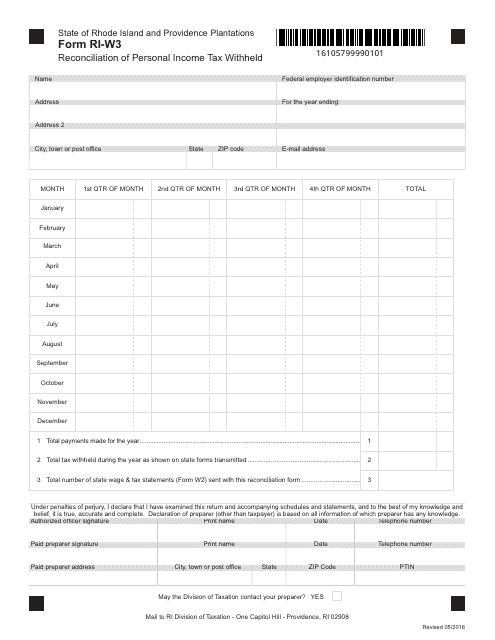

Generally Rhode Island withholding is required to be withheld from the wages of an employee by a Rhode Island employer. 1 The employees wages are subject to federal income tax withholding and 2 Any part of the wages were for services performed in Rhode Island. REPORTING RHODE ISLAND TAX WITHHELD.

375 0. UMass employees who reside in Rhode Island use the RI-W4 form to instruct how RI state taxes should be calculated and withheld. Rhode Island income tax on a current basis on.

Gross Premium Insurance Tax. RI Employer Tax Section 401-574-8700 Option 1 - unemployment and TDI. A resident is defined as anyone who is domiciled in the state or who spends.

In ADV 2021-11 the Rhode Island Division of Taxation announced that it has extended through July 17 2021 previously extended through May 18 2021 emergency regulations that temporarily waive the requirement that employers withhold Rhode Island state income tax from the wages of employees temporarily working within the state solely due to COVID-19. 2021 Employers Income Tax Withholding Tables PDF file less than 1 mb megabytes. Over 66200 but not over 150550.

The Amount of Rhode Island Tax Withholding Should Be. Subscribe for tax news. This form provides a means of paying your.

A Rhode Island employer must withhold Rhode Island income tax from the wages of an.

State Of Rhode Island Division Of Taxation Division Rhode Island Government

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

Tax Withholding For Pensions And Social Security Sensible Money

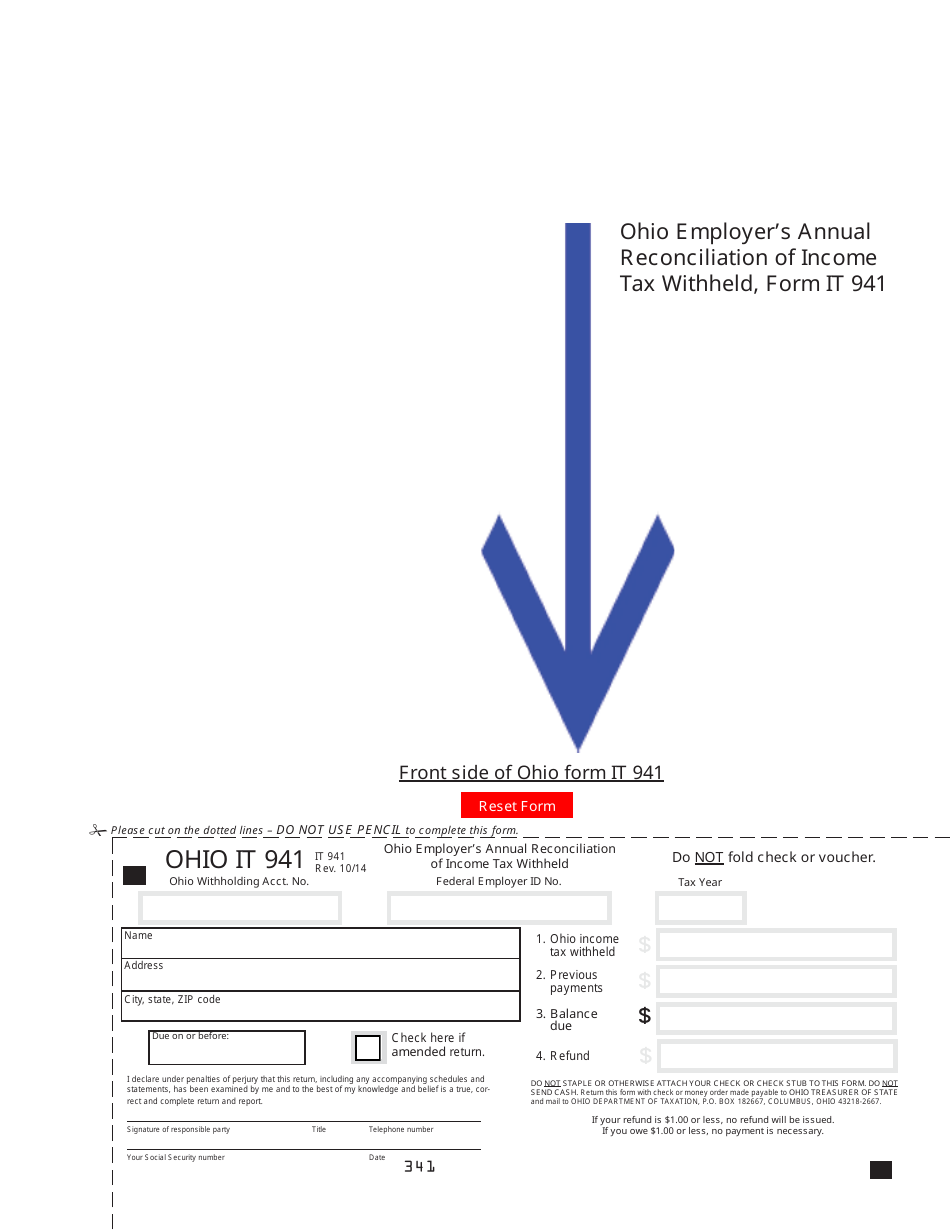

Form It941 Download Fillable Pdf Or Fill Online Ohio Employer S Annual Reconciliation Of Income Tax Withheld Ohio Templateroller

State W 4 Form Detailed Withholding Forms By State Chart

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

State Of Rhode Island Division Of Taxation Division Rhode Island Government

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

Form Ri W3 Download Fillable Pdf Or Fill Online Reconciliation Of Personal Income Tax Withheld Rhode Island Templateroller

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

State W 4 Form Detailed Withholding Forms By State Chart

Withholding Allowances Payroll Exemptions And More

Improved Tax Withholding Estimator Now Available Pg Co

What Is Local Income Tax Types States With Local Income Tax More

Rhode Island Income Tax Ri State Tax Calculator Community Tax